Gen Z are the first true digital natives, and as they step into the workforce, they are already beginning to transform the very concept of a job. No longer merely employees; many are multi-hyphenates -- entrepreneurs, freelancers, and side hustlers – with multiple balls in the air. Their view on work is a response to the changing nature of work itself and a desire for greater control over their lives.

In a recent Forbes article, Mark Beal, an assistant professor of professional practice and communication at Rutgers University, makes the clear-eyed prediction that “Gen Z will transform and disrupt the workplace more than any generation.”

And that workforce disruption will have a downstream impact on car buying as well as their car insurance preferences.

Disrupting The Workforce

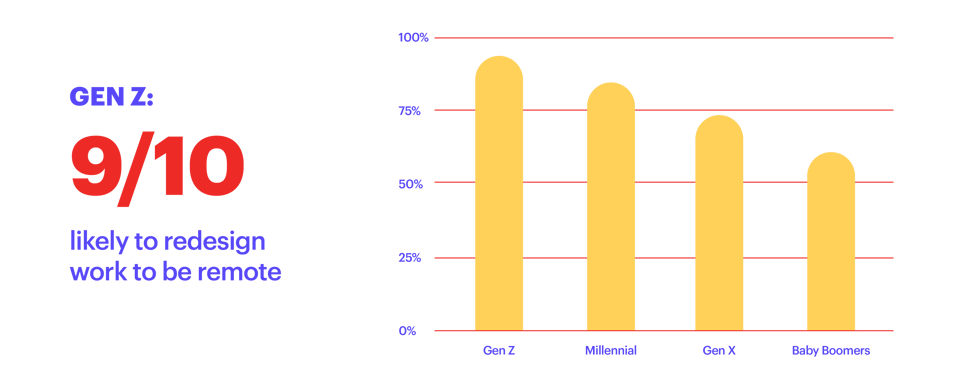

Preference for remote work, participation in the gig economy, and changing values -- working to live, rather than living to work – are all having downstream impacts on their transportation preferences.

Gen Z are the first true digital natives, and as they step into the workforce, they are already beginning to transform the very concept of a job. No longer merely employees; many are multi-hyphenates -- entrepreneurs, freelancers, and side hustlers – with multiple balls in the air. Their view on work is a response to the changing nature of work itself and a desire for greater control over their lives.

In a recent Forbes article, Mark Beal, an assistant professor of professional practice and communication at Rutgers University, makes the clear-eyed prediction that “Gen Z will transform and disrupt the workplace more than any generation.”

And that workforce disruption will have a downstream impact on car buying as well as their car insurance preferences.

Preference for remote work, participation in the gig economy, and changing values -- working to live, rather than living to work – are all having downstream impacts on their transportation preferences.

So, you have a generation that is financially stressed, prefers to work from home, active participants in the gig economy, and fluent digital natives. What does it mean for car and insurance buying?

Impact On Car Buying

Cost of Ownership is at an All Time High. Today, the cost of car ownership is at an all-time high at $12,182, according to AAA’s most recent study. That’s just over $1015 a month. Inflation is having a crushing effect, on almost everyone, everywhere, but especially younger generations who have less buying power on average than older generations. The pressure is driving Gen Z to delay or rethink car ownership.

Alternative Transportation and Shared Ownership Models Gen Z are more likely to explore alternative transportation options like ride-sharing, carpooling, electric scooters, and bicycles. A recent McKinsey study found that around 55% of Gen Z are open to idea of shared mobility. Instead of owning a car, they might opt for convenient access to vehicles when needed through subscription-based services

However, while Gen Zers may be more open to alternative modes of transportation and ownership, they still spend a significant portion of their salary on transportation -- 20 percent according to a Bankrate.com study.

Environmentally Conscious Choices: Gen Z's growing environmental awareness is driving car ownership preferences. A recent Future of Humanity survey found that 41% of respondents, aged 18 to 25, believe that climate change is a number one issue. With their stronger commitment to reducing their carbon footprint, Gen Z is more likely to invest in electric or hybrid vehicles, accelerating the automotive industry’s transformation to EV and other eco-friendly vehicles. In a recent study, the Rocky Mountain Institute predicts that two-thirds of global car sales could be EVs by 2030.

Impact On Car Insurance

The evolving nature of Gen Z’s work and transportation preferences will, of course, have implications for car insurance as well.

Data-Driven Models and Telematics

McKinsey believes that the future of driving and car insurance will be revolutionized by three technologies: advanced vehicle communications, electric cars, and self-driving cars. OEMs already have the technology and access to data to apply real-time driving insights to insurance, and both OEMs and carriers have entered this market to make car ownership and everything surrounding it more efficient.

The McKinsey study also predicts that 90% of new US vehicles will be connected cars by 2050. This trend will only accelerate. Because of Gen Z's comfort with technology and data-sharing, they will both be catalysts for the adoption of connected car models and integrated insurance programs.

Environmentally Conscious Choices Will Drive Tech Advancements

Gen Z is the fastest-growing segment for EV consideration, according to a recent J.D. Power study. EVs are the tip of the spear for the advanced telematics that will change the insurance industry. Gen Z will both drive the change and expect embedded technology by virtue of preferring more environmentally sound car choices.

Digital Natives want a Digital Experience.

In an upcoming Polly 2024 Embedded Car and Insurance Buying study, we found that 80% of Millennials and Gen Z said they think car insurance should be a part of the car-buying process, and they preferred a digital auto insurance app available at the time of car purchase. Technology is embedded into every aspect of Gen Zer’s life, which is why they prefer auto insurance quotes at the time of vehicle purchase.

Wrapping Up

Gen Z’s preference for flexibility, independence, and a diversified income has already begun to influence how work is structured. These changes will impact both the automotive and insurance industries, as Gen Z's priorities and behaviors shape both. There’s a ton of disruption and opportunity on the horizon. We can’t wait to see what the future brings.

Ben Jastatt

Ben is Polly's Senior Director of Marketing Communications. For more than a decade, Ben has led communications and marketing teams within the automotive and technology space. He currently leads the Polly marketing communications and brand functions.